tax reduction strategies for high income earners australia

TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. The ATO is far more likely to ask a lot of questions about your tax.

Tax Planning Strategies For Your 2021 Tax Return Wipfli

For those trying to learn how to save tax in Australia salary sacrificing is one way to do.

. Tax reduction strategies for high income earners australia. Here are 9 ways to accomplish your goal and reduce your tax bill. A discretionary family trust can benefit high-income earners seeking to redistribute some of their income to family members in lower tax brackets.

One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. Holding tax deductable income protection. Delay receiving income to avoid paying tax in the current financial year.

50 Best Ways to Reduce Taxes for High Income Earners. The higher your tax bracket the higher the benefits are of tax savings. Because of the way Australias income tax system is structured moving.

You can currently claim up to 27500 as a tax. This rate is lower than the personal income tax rate. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

As a refresher for 2021 fy the individual tax rates including medicare levy are. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income.

Make spousal contributions to reduce your tax liability. Specifically important numbers for 2022 include. You could pay me 150000 for managing your tax affairs Im not cheap which is fully tax deductible.

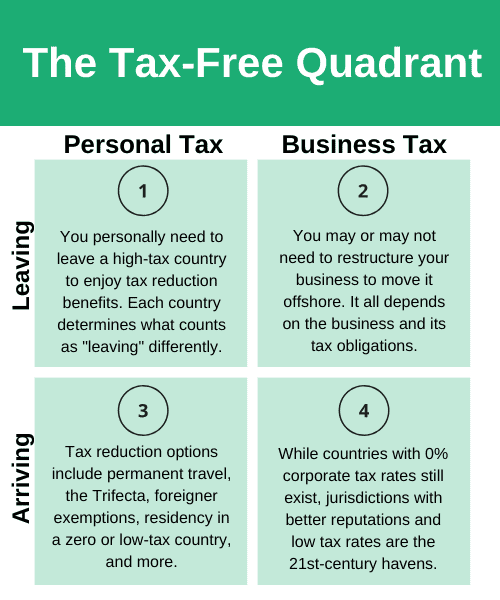

Tax reduction strategies for high-income earners in australia. Being an Australian citizen. Structuring your business and personal assets.

So then your taxable income would be 150000. With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. Consider salary sacrificing to reduce your taxable income.

Most of our Sydney clients are in the top 15 of earners in Australia. To encourage middle to high-income earners to reduce their dependability on the public health system and make the private healthcare industry more sustainable the ATO introduced a private health insurance rebate. The eligibility criteria to receive the tax offset includes.

Investing in Early Stage Investment Companies ESIC Investing in Early Stage Venture Capital Limited partnerships. Home australia high reduction strategies. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. Here are some of the most accessible tax reduction strategies that ATO allows. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Tax reduction strategies. The higher your tax bracket the higher the benefits are of tax savings. As a general overview the most beneficial strategies for tax minimisation are.

The federal income tax is designed to tax higher levels of income at higher tax rates. User 552406 11075 posts. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket.

Investing in lower income earning spouses name may be better. August 12 2014. Max Out Your Retirement Contributions.

15 Easy Ways to Reduce Your Taxable Income in Australia 1. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. Effective tax planning with a qualified accountanttax specialist can help you to do that.

Prepay tax-deductible expenses to bring your tax deduction forward. The contribution you will make will come straight out of your. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Exploring tax savings through depreciation superannuation SMSFs and capital gains tax reductions are just. Keep Accurate Tax and Financial Records.

Private Health Insurance Tax Offset. And given the extortionate rent rates here and median house price I think single. Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and more.

Lets start with retirement accounts. If you are a high-income earner it is sensible to implement tax minimisation strategies. High Income Financial Planning Reduce Tax and Build Wealth.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Tax reduction strategies for high income earners australia Tuesday March 1 2022 Edit. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income.

Distribute more income to beneficiaries on lower tax brackets or. A properly drafted discretionary trust allows trustees to distribute to the most appropriate members regarding their tax status ie. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains.

Take Home Rates for an annual income of 400000. Negatively gearing a property or an investment into shares. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact.

This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. These penalties can range from fines to imprisonment for more. The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020.

There are plenty of opportunities for high-income earners to reduce their tax burden. Your income tax bill sans other levies would be 108232 so youd keep 191768. Hold investments in a discretionary family trust for tax-effective income distribution.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. ATO allows individuals to reduce their tax on salary by claiming deductions on work-related expenses that were not reimbursed by the employer.

The European Union And Latin America And The Caribbean Convergent And Sustainable Strategies In The Current

How To Legally Lower Your Taxes

10 Surefire Tax Tips For Year End 2021

Tax Minimisation Strategies For High Income Earners

6 Ways To Cut Your Income Taxes After A Windfall Cbs News

Proposed Tax Changes For High Income Individuals Ey Us

2021 State Of Remote Work Report Payscale

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Tax Strategies Of The Wealthy Greg Vanderford Skillshare

48 Tax Free Strategies The Roadmap To Financial Freedom With Tom Wheelwright

Tax Planning Strategies For 2021 Tax Year With Mistakes To Avoid Financial Freedom Countdown

Why Passive Income Beats Earned Income

5 Strategies To Reduce Investment Taxes

/GettyImages-469191068-ac2deb35657a41e58de5bd3a2ff27c62.jpg)

Top 6 Strategies To Protect Your Income From Taxes

4 Effective Strategies To Reduce Your Income Taxes

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian